CORPORATE

EXPOSURES

SUMMARY

The

main changes introduced by the Basel IV revisions can be summarised

as follows:

SME’s:

A separate risk weight of 85%, lower than the 100% risk weight

applicable to large unrated corporates, is applied to unrated

exposures to SME’s. Small and Medium Enterprises are defined

as corporates with a maximum turnover of € 50 million. This

aligns the treatment of SME’s to their treatment under the

IRB.

The

risk

weights

associated with external ratings are recalibrated .

The recalibration facilitates the access of standardised banks to

some of the lower risk weights, which it brings more in line with

the IRB risk weights.

If

banks are incorporated in jurisdictions that do not

allow

the use of external ratings for regulatory purposes, they are

permitted to assign a 65% risk weight to the corporates that they

identify as “ investment

grade ” .

Three

categories of “Specialised

lending”

(Object finance, Commodity finance and Project Finance) are

“imported” from the IRB Approaches.

If

the exposure is a claim on a corporate but “ related

to real estate”

then new, separate rules apply, which will be covered in a future

article. Commercial real estate does not have a separate treatment

under the current SA rules. The 100% risk weight applies.

DETAILED

REVIEW

Current

Basel II rules- a refresher

Under

Basel I all

corporate exposures were assigned the same 100% risk weight.

Since

the minimum amount of capital required by Basel I ( and Basel II-III)

is equal to 8% of the risk weighted assets of the bank, this meant

that for a loan of 100 million to a corporate, a bank had to allocate

an amount of capital of at least 8 million : 100 million x 8% x 100%

= 8 million.

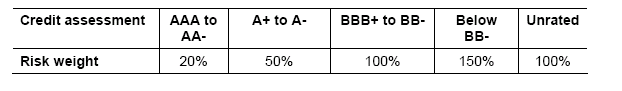

The

main innovation of the existing Standardised Approach was to allow

banks to use external ratings (i.e. the ratings of credit agencies

such as Moody’s, S&P etc.) to access the lower risk weights

associated with high(er) credit ratings, as shown in the table below.

This

means, as an example, that the capital required for a loan of 100

million to a company rated AA, which was 8 million under Basel I as

shown above, is now 100 million x 8% x 20% = 1.6 million.

Because

of the lower risk weight of 20%, the capital requirement is divided

by 5 and, accordingly, the return on that loan is multiplied by 5.

Basel

II, again to encourage banks to move away from the Standardised

Approach and use the IRB Approaches instead, deliberately set the bar

very high: only exposures to corporates rated A- or better (there are

not that many of these) enjoy a risk weight lower than 100%.

Even

exposures to BBB- to BBB+ corporates, which are

investment grade, are still risk-weighted 100%.

And

so are unrated exposures, which of course, on a worldwide basis,

vastly outnumber the rated ones. This is particularly true of

emerging markets, where the pool of rated companies is limited.

Basel

IV

In

order to “enhance the credit risk sensitivity of the

Standardised Approach”, the corporate exposure class now

differentiates between “General corporate exposures” and

“Specialised lending exposures”.

General

corporate exposures

There

are now in effect 3 different regimes:

A.

Jurisdictions where the use of external ratings is allowed.

Banks

incorporated in a jurisdiction that allows the use of external

ratings

must assign risk weights according to the table below, which is

extracted from the Basel IV Revisions.

What

has changed is the recalibration of the risk weights. Contrary to the

current table discussed above, exposures to corporates rated BBB- to

BBB+, which are investment grade, are assigned a 75% risk weight

instead of the current 100%.

This

risk weight is also more closely aligned to the risk weight produced

by the IRB Risk Weight Function for a credit of similar quality,

which of course was the objective.

B.

Jurisdictions where external ratings are not allowed

For

corporate exposures of banks incorporated in jurisdictions that do

not

allow

the use of external ratings for regulatory purposes, banks must

assign a 100%

risk weight to all corporate exposures, with the exception of

exposures to corporates identified by the bank as “investment

grade”

in which case the risk weight is 65%.

The

Revisions define an investment grade corporate as: “a corporate

entity that has adequate capacity to meet its financial commitments

in a timely manner and its ability to do so is assessed to be robust

against adverse changes in the economic cycle and business

conditions. When making this determination, the bank should assess

the corporate entity against the investment grade definition taking

into account the complexity of its business model, performance

against industry and peers, and risks posed by the entity’s

operating environment.

Moreover,

the corporate entity (or its parent company) must have securities

outstanding on a recognised securities exchange.”

In

other words, apart from the stock exchange listing requirement, all a

bank has to do to qualify for this treatment is to be able to conduct

a well informed and argued credit analysis to justify its decision.

Nothing

extraordinary here. Banks, standardised or not, should, indeed must,

be able to conduct proper credit analyses.

Nevertheless,

this is the first time banks using the Standardised Approach are

allowed to use their own judgement to rate a corporate.

What

you may find intriguing, or even disappointing, about this new

provision however is its limited scope of application.

Why

indeed restrict it to jurisdictions where the use of external ratings

is not

allowed?

Unrated

exposures vastly outnumber rated ones even where external ratings are

allowed,

so why not apply this provision to all unrated exposures, wherever

they are? And why create a different treatment solely for “investment

grade” corporates and not a scale of several risk grades, good

and bad?

More

broadly, how does this limitation reconcile with the Basel

Committee’s stated policy to grant more discretion to banks in

the revised Standardised Approach?

Looking

at the consultations that preceded the publication of the Basel IV

Revisions, I think that the discretion granted to banks by this

provision is less an example of a change in policy than the

confirmation of the BCBS’ capitulation on that front.

The

original intention of the Basel Committee was in fact to eliminate

the use of external ratings altogether. They had become unpopular

after the financial crisis and, perhaps more importantly, were

perceived as too much of a mechanical substitute for credit analyses.

All

valid concerns.

So,

the proposal was to replace them with 2 metrics: revenues (Turnover)

and a leverage ratio (Assets to equity), which the Basel committee

thought had predictive value, at least statistically.

Perhaps

surprisingly the feedback from the industry was negative, on the

grounds that the calculation of the metrics by banks would have

created inconsistencies between jurisdictions.

Given

the very basic nature of the calculations in question, I doubt very

much it would have been the case, at least not to the extent of

disrupting the comparability of ratings and risk weights.

The

Standardised Approach might have taken a different turn and ended up

looking very different but what prevailed in the end, with some

irony, is the pretty dim view banks seem to take of their own

analytical abilities.

Comparability

and uniformity won the day and the pendulum swung all the way back to

external ratings, except in jurisdictions that could not/did not want

to use them.

C.

SME’s

For

unrated exposures to corporate

SMEs

(defined as “corporate exposures where the reported annual

sales for the consolidated group of which the corporate counterparty

is a part is less than or equal to

€50

million

for the most recent financial year”), an 85%

risk weight

will

be applied.

Under

the IRB Approaches, the same SME’s enjoy a specific Risk Weight

Function (RWF), which generates lower risk weights than the RWF used

for large corporates. This favourable treatment is now replicated in

the SA.

Note

that the new rules applicable to retail exposures specifically allow

banks to include these exposures, which are corporate

exposures,

in their “qualifying retail

portfolios”,

provided the qualifying criteria are met. These criteria are reviewed

in the article dedicated to retail exposures.

Qualifying

retail exposures are assigned a 75%

risk weight ,

better than the 85% “normal” SME risk weight.

Specialised

lending exposures

These

categories are similar to the IRB Specialised Lending categories,

which are “imported” into the Standardised Approach.

Currently

these exposures are treated as corporate exposures, which means that

unless they take the form of an investment in an instrument (E.g.

bond) with an issue-specific

external rating, the applicable risk weight is 100%.

Categories

Specialised

lending cannot be related

to real estate, which

is treated separately under Basel IV.

The

exposure is typically to an

entity

(often a special purpose vehicle (SPV)) that was created specifically

to finance and/or operate physical assets; the

borrowing entity has few

or no other material assets or activities, and therefore little or no

independent capacity to

repay the obligation, apart from the income that it receives from the

asset(s) being financed.

Specialised

lending comprises the following three subcategories of specialised

lending:

(i)

Project

finance

refers to the method of funding in which the lender looks primarily

to the revenues generated by a single project, both as the source of

repayment and as security for the loan.

(ii)

Object

finance

refers to the method of funding the acquisition of equipment (e.g.

ships, aircraft, satellites, railcars, and fleets) where the

repayment of the loan is dependent on the cash flows generated by the

specific assets that have been financed and pledged or assigned to

the lender.

(iii)

Commodities

finance refers to short-term lending to finance reserves,

inventories, or receivables of exchange-traded commodities (e.g.

crude oil, metals, or crops), where the loan will be repaid from the

proceeds of the sale of the commodity and the borrower has no

independent capacity to repay the loan.

Treatment

If

external issue-specific

ratings are allowed and available, the

Table 10 (See above) used

for general corporates

applies.

This

provision only clarifies the current regime.

If

external issue-specific ratings are not allowed or not available:

This

new provision in fact changes nothing.

130%

during the pre-operational phase

100%

during the operational phase

80%

for operational phase and deemed to be high quality

“ Operational

phase” is defined as the phase in which the entity that was

specifically created to finance the project has (i) a positive net

cash flow that is sufficient to cover any remaining contractual

obligation, and (ii) declining long term debt.

A

“high quality” project finance exposure refers to an

exposure to a project finance entity that is able to meet its

financial commitments in a timely manner and its ability to do so is

assessed to be robust against adverse changes in the economic cycle

and business conditions.

ASSESSMENT

Overall,

the Basel IV rules on corporate claims do what it says on the tin:

the Standardised Approach looks more like the IRB Approaches and

their respective capital outputs are more closely aligned.

The

treatment of exposures to corporate SME’s makes sense and the

option to include them in qualifying retail portfolios, a somewhat

confusing issue under the current rules, has been clarified.

The

recalibration of the risk weights associated with external ratings

also goes in the right direction although its impact is limited as it

only affects corporates rated BBB- to BBB+.

A

different, separate treatment for real estate exposures is also a

positive development. As history has shown time and time again,

commercial real estate can be a disproportionately large asset class

for many banks and a risky, even dangerous one. This asset class will

be reviewed in future articles.

Some

of the new provisions, however, are less convincing:

First,

there doesn’t seem to be much point in creating new special

lending categories like Object and Commodity finance, if it is to

treat them exactly as before.

There

is, in the IRB Approaches, a ready-made supervisory scale for these

exposures that could have been imported.

Then

there is the capitulation of the Basel Committee on the use of

financial metrics, which were sacrificed on the altar of uniformity.

I

think it is regrettable. Potentially hiding exposures to highly

geared corporates behind a 100% risk weight is a major weakness of

the Standardised Approach, and if banks are unable to “calculate”

a company’s turnover or leverage, maybe they shouldn’t be

in banking at all.

|